Analysis by Insurance Risk Data of combined ratios reveals reallocating is one of many 'levers' insurers can pull to bolster profits. David Walker reports

Europe's general insurers are increasingly in search of profit, reliant on investing and let down by underwriting to generate earnings.

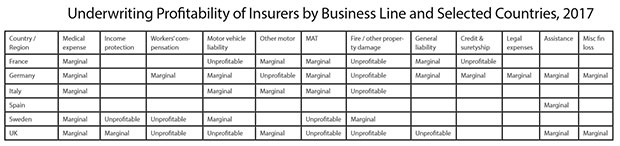

Calculations of combined ratios (CORs) across 12 lines of business by Insurance Risk Data, the data service linked to Insurance Asset Risk, reveals that nearly eight in every 10 euros of gross premium income that insurers took in during 2017 were loss-making.

The CORs were either more than 100%, which indicates an underwriting loss, or between 90% and 100%, which Insurance Asset Risk regards as inhabiting a 'danger zone' of marginal profitability.

Insurance Risk Data's analysis encompassed the public Solvency II filings of about 1,700 solo entities, across the European Economic Area (the EU plus Iceland, Liechtenstein and Norway). It standardised figures to euros, as at the end of 2017.

Gross written premiums of €184.3bn ($216.8bn) had CORs of more than 100%. Some €146bn more generated a COR of between 90% and 100%.

Against this backdrop it is logical underwriters turn, at least in part, to their investments to help.

Asset managers may salivate at this thought, but they should realise no two insurers have the same investment appetite.

Insurance Risk Data looked at non-life insurers' investment patterns after segmenting the sector by gross written premiums.

Across the largest (with GWP of above €500m), mid-sized (GWP between €100m and €500m) and smaller (GWP below €100m) insurers, government and corporate bonds combined always exceeded half the general account (GA) portfolio.

But the largest were less reliant on govvies, so their sovereigns plus credit only just tipped 50% of their average GA. Perhaps unsurprisingly, far larger proportions of bigger insurers' GA were absorbed by holdings in related undertakings. The appetite for funds was always a double-digit proportion, but appetite differed between size segments.

By line of business, the marine, aviation and transport segment was the most marginal business by proportion of its total GWP. Only 5.3% of the GWPs written for it last year exhibited combined ratios of less than 90%.

Medical expense insurance was in only slightly better territory, with 8% of GWPs returning a safe profit.

For motor vehicle liability insurance, which is an intensely competitive but voluminous business line characterised by fickle consumers and tight margins, insurers only managed to write 19.6% of this business on a COR of less than 90%.

Rating agency Fitch expects 2018 to be punctuated by plentiful M&A as underwriters buy into more profitable lines, and trim or axe their involvement in perennially unprofitable business lines or those with deteriorating profitability.

However, Harish Gohil, head of insurance for the EMEA region at rating agency Fitch, said a poor COR figure for some lines of business would not necessarily determine whether an underwriter would abandon those lines.

For instance, motor liability cover is mandatory in many countries, Gohil said, so it generates great volumes of GWP - €70.6bn in 2017, according to Insurance Risk Data's EEA database. Therefore, underwriters may stick with it even on tight margins. A COR of 98% for this line might be acceptable for some underwriters, he said, as motor liability could function as loss-leader for firms who may seek to sell their customers other, more profitable, types of insurance.

Profitability of the "fire and other property damage" business suffered in 2017 from the string of hurricanes in the US and Caribbean, and the Californian wildfires. In such circumstances, Gohil said Fitch would want an underwriter to generate very healthy CORs in years of light claims, recognising that a bad year could then generate a high COR. Fitch would be willing to 'look through' such a year, to judge a property insurer's underwriting performance over many years, he said.

That 2017 was a tough year to write non-life custom is fairly clear. What is less so is whether the sector turned to its general account investments, to stay in the black.

Gohil said the insurers would still want liquidity in their investments, for when mishaps hit customers, so a move into yield-enhancing, long-term investments such as infrastructure or property is far less clear-cut than it is among life insurers.

Pockets of 'long-tail' business do exist in the non-life world, such as in parts of motor cover. This might allow an underwriter, all else being equal, to put its toes in the water of longer-term asset classes.

But it was more likely that a general underwriter would buy, and simply hold for a bit longer, instruments such as corporate bonds, which should still be saleable in liquid markets, Gohil said.

So far this year, the more visible actions that non-life insurers are taking to bolster profitability, or stay afloat, are capital calls, and M&A to buy into lines of work with fatter margins, and trim or exit less profitable ones.

But expect general insurers to examine how hard their investments are working for them and, without sacrificing too much liquidity or adding too much in capital requirements, to rotate to better-yielding assets.

The analysis presented in this article forms part of a new in-depth qualitative and quantitative industry report from Insurance Risk Data, comprising in-depth country-by-country analysis and comprehensive data on insurers in the EEA. Insurance Risk Data is a comprehensive database of European Solvency II filings, owned by Field Gibson Media, the publishers of Insurance Asset Risk and InsuranceERM. For more information about this report or to request a copy, and for more information about the data service Insurance Risk Data mentioned in this article, please contact Phil Manley, phil.manley@fieldgibsonmedia.com.

People:Harish Gohil